IFRS- International Financial Reporting Standards

IFRS- International Financial Reporting Standards

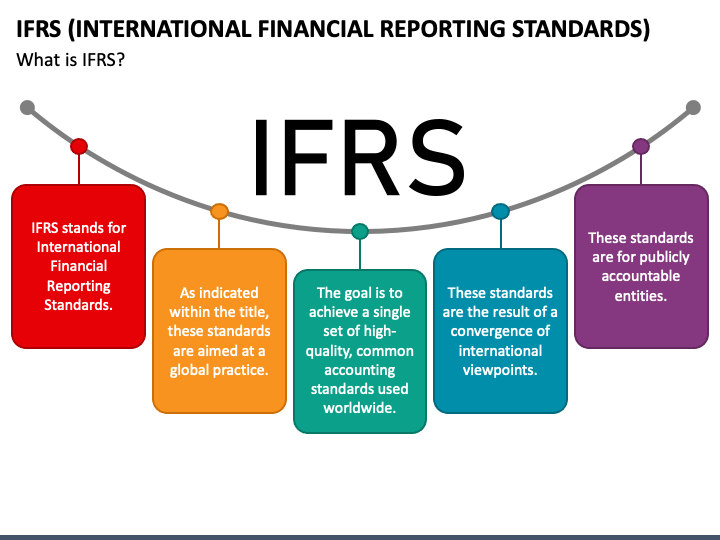

IFRS, or International Financial Reporting Standards, are a set of accounting standards developed by the International Accounting Standards Board (IASB) to provide a common global framework for financial reporting. These standards aim to enhance transparency, comparability, and understandability of financial statements across different countries and industries.

1. Global Adoption: IFRS is widely adopted by more than 140 countries around the world, including the European Union, Australia, Canada, and many emerging economies. It is increasingly becoming the global standard for financial reporting, facilitating cross-border comparisons and investment decisions.

2. Principles-Based Approach: IFRS is based on a principles-based approach, focusing on the substance of transactions rather than strict adherence to rules. This allows companies flexibility in applying accounting standards to reflect the economic reality of transactions and events.

3. Comprehensive Framework: IFRS comprises a comprehensive set of accounting standards covering various aspects of financial reporting, including the recognition, measurement, presentation, and disclosure of financial information. These standards provide guidance on topics such as revenue recognition, leases, financial instruments, and business combinations.

4. Convergence and Harmonization: IFRS aims to promote convergence and harmonization of accounting practices globally by aligning with other major accounting standards, such as US Generally Accepted Accounting Principles (US GAAP). Efforts towards convergence help reduce differences between accounting standards and facilitate international comparability.

5. Disclosure Requirements: IFRS emphasizes the importance of transparent and comprehensive disclosures in financial statements to provide stakeholders with relevant information for decision-making. Companies are required to disclose significant accounting policies, estimates, judgments, and other relevant information in the notes to financial statements.

6. IFRS Foundation and IASB: The IFRS Foundation is responsible for the oversight and governance of the IFRS framework, including the International Accounting Standards Board (IASB), which develops and maintains IFRS standards. The IASB comprises international accounting experts who are responsible for setting and revising accounting standards.

7. IFRS Adoption and Transition: Countries that adopt IFRS often undergo a process of transition from their previous accounting standards to IFRS. This involves assessing the impact of IFRS adoption on financial reporting, implementing changes to accounting policies and systems, and providing comparative financial information for prior periods.

8. Audit and Assurance: Financial statements prepared under IFRS are subject to audit and assurance procedures conducted by independent auditors. Auditors examine financial statements, assess internal controls, and issue audit reports expressing their opinion on the fairness of presentation and compliance with accounting standards.

9. Updates and Amendments: IFRS standards are periodically updated and amended by the IASB to reflect changes in accounting practices, emerging issues, and regulatory developments. Companies are required to stay updated on the latest amendments and comply with revised accounting standards and disclosure requirements.

Overall, IFRS plays a crucial role in promoting transparency, comparability, and reliability in financial reporting on a global scale. Adoption of IFRS facilitates international business transactions, enhances investor confidence, and supports economic growth and development by providing stakeholders with consistent and relevant financial information.

Why Us?

Singh Suri & Company, Chartered Accountants in India offer a range of services related to International Financial Reporting Standards (IFRS) to assist companies in adopting, implementing, and complying with IFRS requirements. These services are designed to help companies navigate the complexities of IFRS, ensure accurate and transparent financial reporting, and meet regulatory obligations.

1. IFRS Adoption and Implementation: We assist companies in transitioning from Indian Accounting Standards (Ind AS) or Indian Generally Accepted Accounting Principles (Indian GAAP) to IFRS. We help companies understand the differences between IFRS and Indian accounting standards, assess the impact of IFRS adoption on financial statements, and develop a roadmap for implementation.

2. IFRS Conversion and Restatement: We help companies convert their financial statements from Indian GAAP or Ind AS to IFRS. This involves restating financial information for prior periods to comply with IFRS requirements, providing reconciliations between previous accounting standards and IFRS, and ensuring compliance with transition disclosures.

3. IFRS Training and Education: We conduct training programs, workshops, and seminars to educate companies, finance professionals, and other stakeholders on IFRS requirements, updates, and best practices. We provide guidance on understanding and applying IFRS principles, policies, and disclosure requirements.

4. IFRS Advisory and Consultancy: We offer advisory services on IFRS-related matters, including interpretation of accounting standards, resolution of accounting issues, and implementation of complex accounting treatments. We provide guidance and recommendations to companies on IFRS compliance, financial reporting practices, and regulatory updates.

5. IFRS Impact Assessment: We conduct impact assessments to evaluate the financial, operational, and regulatory implications of IFRS adoption on companies. We analyze the impact of IFRS on key financial metrics, performance indicators, taxation, and compliance requirements, providing insights to management and stakeholders.

6. IFRS Compliance and Disclosure: We assist companies in complying with IFRS requirements for financial reporting, disclosure, and presentation. We ensure that financial statements are prepared in accordance with applicable IFRS standards, including the disclosure of significant accounting policies, estimates, and other relevant information.

7. IFRS Audit and Assurance: Financial statements prepared under IFRS are subject to audit and assurance procedures conducted by statutory auditors. We examine financial statements, assess internal controls, and issue audit reports expressing their opinion on the fairness of presentation and compliance with IFRS.

8. IFRS Updates and Amendments: We keep companies informed about updates, amendments, and revisions to IFRS issued by the International Accounting Standards Board (IASB). We assist companies in understanding and implementing changes to accounting standards and disclosure requirements.

Singh Suri & Company, Chartered Accountants play a crucial role in providing IFRS services to companies in India, ensuring accurate, transparent, and compliant financial reporting under IFRS. We help companies navigate the transition to IFRS, comply with regulatory requirements, and enhance the quality and reliability of financial information for stakeholders.