Cross Border Transaction Advisory

Cross Border Transaction Advisory

Cross-border transactions refer to financial transactions or commercial activities that involve parties from different countries. These transactions can take various forms, including trade in goods and services, investment in assets or securities, borrowing and lending of funds, and transfer of technology or intellectual property rights.

1. International Parties: Cross-border transactions involve parties located in different countries, such as buyers and sellers, investors and issuers, lenders and borrowers, or licensors and licensees.

2. Different Legal and Regulatory Frameworks: Cross-border transactions are subject to the legal and regulatory frameworks of multiple countries, including laws governing contracts, trade, investment, taxation, and foreign exchange.

3. Currency Exchange: Cross-border transactions often involve transactions in different currencies, requiring currency conversion and foreign exchange transactions to settle payments or obligations between parties.

4. Risk Factors: Cross-border transactions may involve additional risks compared to domestic transactions, including currency risk, political risk, legal risk, regulatory risk, and cultural differences.

5. Tax Implications: Cross-border transactions can have significant tax implications for the parties involved, including taxation of income, capital gains, dividends, interest, royalties, and withholding taxes. Tax considerations often play a crucial role in structuring cross-border transactions to optimize tax efficiency and mitigate tax risks.

6. Complexity: Cross-border transactions tend to be more complex than domestic transactions due to the involvement of multiple jurisdictions, legal systems, languages, currencies, and cultural differences. They may require specialized expertise and resources to navigate effectively.

These are the following

- Import and export of goods and services between countries

- Foreign direct investment (FDI) in businesses or real estate in other countries

- Cross-border mergers and acquisitions (M&A) involving companies from different countries

- International joint ventures and strategic alliances between businesses from different countries

- Cross-border financing arrangements, such as syndicated loans, project finance, and bond issuances

- Licensing and franchising agreements for the use of intellectual property rights across borders

- Cross-border technology transfers, research collaborations, and technology licensing agreements

- Overall, cross-border transactions play a vital role in promoting global trade, investment, and economic integration, but they also present unique challenges and risks that require careful planning, execution, and management by the parties involved.

Chartered Accountants provide a range of services to assist businesses and individuals with cross-border transactions, ensuring compliance with regulatory requirements, optimizing tax efficiency, and managing risks associated with international business activities. Here are some key services offered by Chartered Accountants for cross-border transactions:

1. Tax Planning and Structuring: We help businesses and individuals optimize their tax position by structuring cross-border transactions in a tax-efficient manner. We analyze the tax implications of different transaction structures, assess the applicability of tax treaties, and recommend strategies to minimize tax liabilities while complying with relevant tax laws.

2. Transfer Pricing Compliance: We assist multinational corporations in complying with transfer pricing regulations for cross-border transactions between related parties. We help businesses establish and document arm’s length prices for intercompany transactions, prepare transfer pricing documentation, and assist in transfer pricing audits and disputes.

3. International Tax Compliance: We provide assistance with international tax compliance, including preparing and filing tax returns for businesses and individuals engaged in cross-border transactions. We ensure compliance with tax laws and regulations in multiple jurisdictions, including reporting requirements for foreign assets, income, and investments.

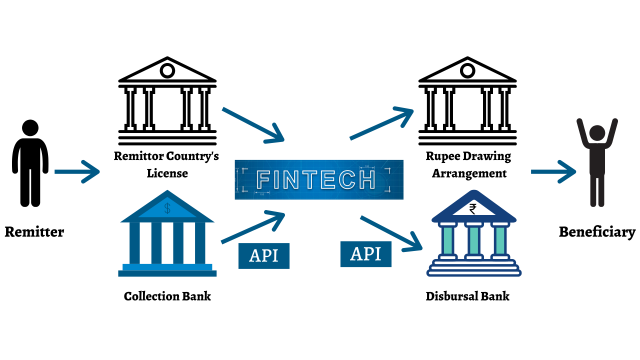

4. Foreign Exchange Management: We advise businesses on foreign exchange management and regulatory compliance for cross-border transactions. We assist in navigating foreign exchange regulations, obtaining necessary approvals, and managing currency risks associated with international trade, investments, and financing activities.

5. Cross-border Mergers and Acquisitions (M&A): We offer advisory services for cross-border M&A transactions, including due diligence, valuation, deal structuring, and post-merger integration. We help businesses identify potential M&A targets, assess risks and opportunities, and execute transactions effectively across borders.

6. International Financial Reporting Standards (IFRS): We assist multinational corporations in complying with IFRS for financial reporting purposes. We help businesses prepare and interpret financial statements in accordance with IFRS requirements, ensuring transparency and consistency in reporting across borders.

7. Cross-border Transaction Support: We provide transaction support services for cross-border transactions, including financial due diligence, transaction advisory, and deal negotiation support. We help businesses assess the financial and operational risks associated with cross-border transactions and make informed decisions.

8. Cross-border Investment Advisory: We offer investment advisory services to individuals and businesses seeking to invest or expand their presence across borders. We assess investment opportunities, conduct market research, evaluate regulatory requirements, and provide guidance on investment strategies and risk management.

9. International Business Expansion Planning: We assist businesses in planning and executing international expansion strategies, including market entry, establishment of foreign subsidiaries or branches, and compliance with legal, tax, and regulatory requirements in target markets.

10. Cross-border Transaction Training and Education: We conduct training programs and workshops to educate businesses and professionals on cross-border transactional matters, including tax implications, regulatory compliance, risk management, and best practices for conducting business internationally.

These are some of the key services provided by Singh Suri & Company, Chartered Accountants to assist businesses and individuals with cross-border transactions. By leveraging our expertise in international taxation, regulatory compliance, and financial management, We assisst clients navigate the complexities of cross-border transactions and achieve their business objectives in the global marketplace.