Goods and Services Tax (GST)

Goods and Services Tax

Goods and Services Tax (GST) in India is a comprehensive indirect tax levied on the supply of goods and services across the country. It was introduced on July 1, 2017, replacing various indirect taxes like the Value Added Tax (VAT), Service Tax, Central Excise Duty, etc. GST is administered by the Goods and Services Tax Council, which is chaired by the Union Finance Minister of India and comprises representatives from the central and state governments.

GST in India is structured into four tax slabs: 5%, 12%, 18%, and 28%, with certain essential items attracting no tax or falling under the exempted category. Additionally, there are special rates for gold, rough diamonds, and certain other goods. Some items like petroleum products, alcohol for human consumption, and electricity are kept outside the purview of GST and are subject to separate taxation by the respective state governments.

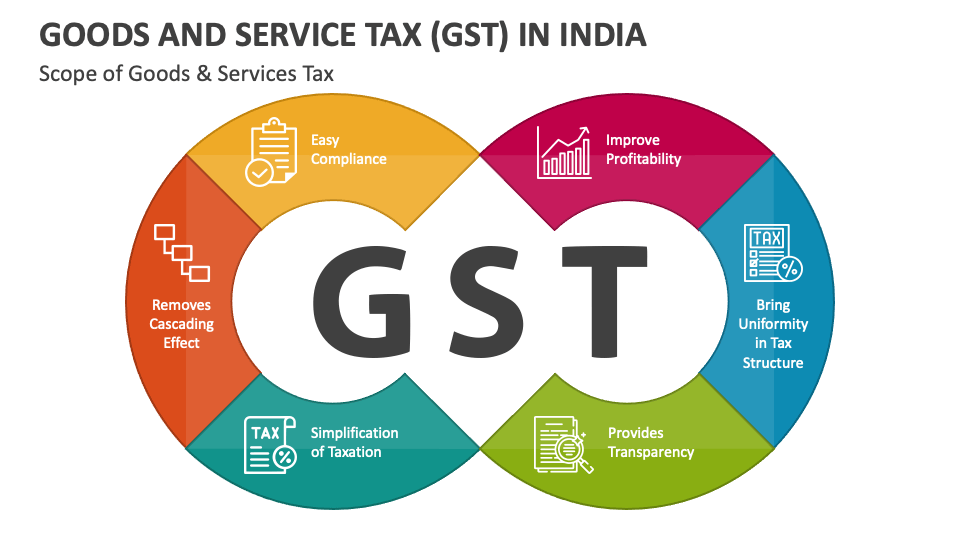

The implementation of GST aimed to simplify the tax structure, eliminate the cascading effect of taxes, promote ease of doing business, and create a unified national market. While it has streamlined the indirect tax system to a considerable extent, there have been challenges in its implementation, such as compliance issues, technology glitches, and transition hurdles for businesses. However, over time, the system has evolved, and efforts continue to address these challenges and refine the GST framework for better effectiveness.

Why Us

We, Singh Suri & Company, Chartered Accountants provide a range of Goods and Services Tax (GST) services to businesses to ensure compliance with GST regulations and optimize their tax positions.

1. GST Registration: We assist businesses in determining their GST registration requirements based on turnover thresholds and other criteria set by the tax authorities. They help with the preparation and submission of GST registration applications and ensure compliance with registration deadlines.

2. GST Compliance and Filing: We help businesses comply with GST requirements by preparing and filing GST returns, including GSTR-1 (outward supplies), GSTR-3B (summary return), GSTR-9 (annual return), and any other applicable returns. We ensure accurate reporting of GST transactions and timely filing to avoid penalties

3. GST Advisory and Consulting: We provide advisory services on GST matters, including interpretation of GST laws, regulations, and notifications. We offer guidance on GST implications for various business transactions, such as mergers, acquisitions, restructuring, and cross-border transactions.

4. GST Audit and Assurance: We conduct GST audits to assess the accuracy and compliance of GST returns filed by businesses. We review GST transactions, reconcile input tax credits, verify compliance with GST laws and regulations, and provide assurance on the accuracy of GST reporting.

5. GST Refund Claims: We assist businesses in preparing and filing GST refund claims for eligible input tax credits, exports, inverted duty structure, and other refundable amounts. We ensure that refund claims are accurately prepared and supported by relevant documentation to expedite the refund process.

6. GST Health Checks and Reviews: We perform GST health checks and reviews to assess the adequacy of internal controls, GST processes, and compliance procedures implemented by businesses. We identify areas of non-compliance, risks, and opportunities for improvement to enhance GST compliance and efficiency.

7. GST Litigation Support: We provide support to businesses in GST litigation matters, including representation before tax authorities, appellate authorities, and tribunals. We assist in preparing responses to GST notices, attending hearings, and presenting arguments to defend the company’s position.

8. GST Training and Workshops: We offer training programs, workshops, and seminars to educate businesses and their employees on GST concepts, compliance requirements, and recent developments. We provide customized training sessions to address specific industry sectors and business needs.

Overall, We Singh Suri & Company, Chartered Accountants play a vital role in assisting businesses with various aspects of GST compliance, advisory, and litigation support, helping them navigate the complexities of GST laws and regulations while optimizing their tax positions and mitigating risks.