Transfer Pricing

Transfer Pricing

Transfer pricing regulations in India are governed primarily by the Income Tax Act, 1961, specifically Section 92 to Section 92F and Rule 10A to Rule 10E of the Income Tax Rules, 1962. These regulations aim to ensure that transactions between related parties are conducted at arm’s length, meaning they should be priced as if they were between unrelated parties. This is to prevent tax evasion through artificially inflating or deflating prices in cross-border transactions.

1. Arm’s Length Principle (ALP): Transactions between related parties should be priced similarly to transactions between unrelated parties under similar circumstances. If the prices deviate from what would be expected under normal market conditions, adjustments may be made by tax authorities.

2. Related Parties: These include entities where one has direct or indirect control over the other, or where both are under common control. This can include parent companies, subsidiaries, sister concerns, etc.

3. Documentation Requirements: Taxpayers are required to maintain detailed documentation to demonstrate that their transactions with related parties comply with the arm’s length principle. This documentation typically includes information about the entity, its business activities, details of related party transactions, analysis supporting the pricing, and any comparable transactions used for benchmarking.

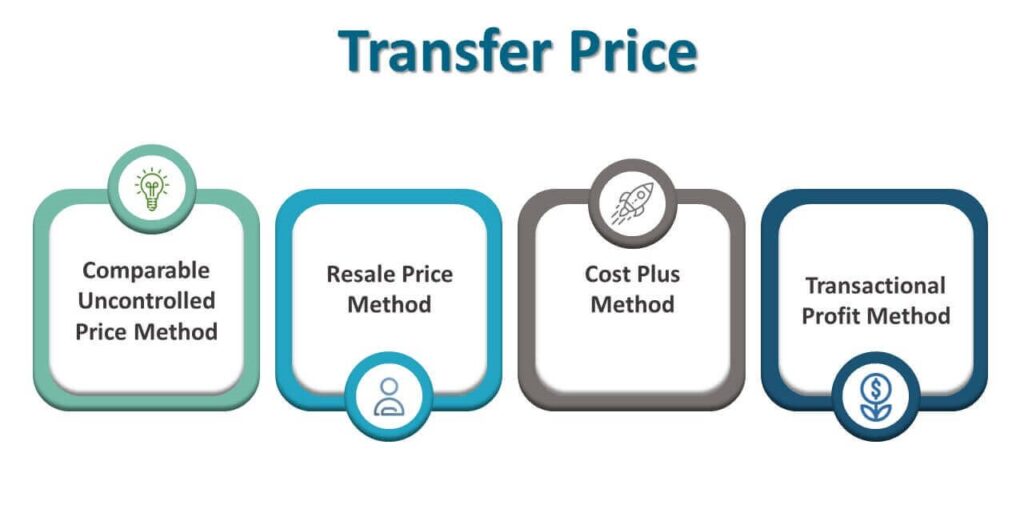

4. Methods for Determining ALP: There are several methods recognized for determining the arm’s length price, including Comparable Uncontrolled Price (CUP) method, Resale Price Method (RPM), Cost Plus Method (CPM), Profit Split Method (PSM), and Transactional Net Margin Method (TNMM). Taxpayers must select the most appropriate method based on the nature of the transaction and the availability of reliable data.

5. Advance Pricing Agreements (APAs): Taxpayers can enter into APAs with tax authorities to determine the appropriate transfer pricing methodology and pricing for future transactions with related parties. This provides certainty and reduces the risk of transfer pricing disputes.

6. Penalties: Failure to comply with transfer pricing regulations can result in penalties and adjustments to the taxable income of the taxpayer.

India’s transfer pricing regulations are complex and subject to frequent updates and amendments to align with international standards and practices. It’s essential for multinational enterprises operating in India to understand and comply with these regulations to mitigate the risk of tax disputes and penalties.

Why Us?

Transfer pricing services provided by Our Firm Singh Suri & Company, Chartered Accountants, involve helping multinational companies establish and maintain arm’s length pricing for transactions between related entities across different tax jurisdictions. These services ensure compliance with transfer pricing regulations and help companies manage tax risks effectively.

1. Transfer Pricing Planning: We assist multinational companies in developing transfer pricing policies and strategies that align with their business objectives while complying with local tax regulations and international transfer pricing guidelines. This includes analyzing the company’s intercompany transactions, identifying transfer pricing risks, and designing appropriate pricing methodologies.

2. Transfer Pricing Documentation: We help companies prepare transfer pricing documentation to support their transfer pricing policies and methodologies. This documentation typically includes a transfer pricing policy statement, a master file, and local country documentation that provide a comprehensive overview of the company’s transfer pricing practices and compliance efforts.

3. Transfer Pricing Compliance: We assist companies in complying with transfer pricing regulations in various jurisdictions where they operate. This involves ensuring that intercompany transactions are conducted at arm’s length prices, preparing transfer pricing reports, and filing transfer pricing documentation with tax authorities as required by local regulations.

4. Transfer Pricing Reviews and Audits: We conduct transfer pricing reviews and audits to assess the compliance and effectiveness of a company’s transfer pricing policies and practices. This may involve reviewing transfer pricing documentation, conducting benchmarking studies, and assisting in responding to inquiries from tax authorities.

5. Advance Pricing Agreements (APAs): We help companies negotiate APAs with tax authorities to obtain certainty and predictability in their transfer pricing arrangements. APAs are agreements between taxpayers and tax authorities that establish the acceptable transfer pricing methods and pricing ranges for specific transactions over a predetermined period.

6. Transfer Pricing Dispute Resolution: We assist companies in resolving transfer pricing disputes with tax authorities through negotiation, mediation, arbitration, or litigation. This includes representing the company’s interests during transfer pricing audits, appeals, and dispute resolution proceedings to achieve a favorable outcome.

7. Transfer Pricing Training and Education: We provide training and education to company personnel on transfer pricing concepts, regulations, and compliance requirements. This helps ensure that employees involved in intercompany transactions understand their roles and responsibilities in managing transfer pricing risks effectively.

Overall, transfer pricing services provided by Singh Suri & Company, Chartered Accountants play a crucial role in helping multinational companies navigate the complex landscape of transfer pricing regulations, mitigate tax risks, and optimize their global tax positions while maintaining compliance with local tax laws and regulations.